Utilizing The Public Finance Management Act 2012

Utilizing The Public Finance Management Act 2012 in tackling Public entities receiving disclaimer of opinion

The Office of the Auditor General draws its mandate from the constitution of Kenya chapter 12, part 6, Article 229 which establishes the office of the Auditor General. While chapter 15 Article 248, section 3 and Article 249, Section 2 (a) and (b) provides for the independence of the office of the Auditor General. One of the major functions of the OAG is to audit and report on the accounts of an entity that is funded from public funds. The office issues three types of opinion in regards to the financial statements of an entity namely unqualified, qualified and adverse opinion. When the auditor general awards an unqualified opinion, it means that an entity’s financial statements are fairly and appropriately presented without exceptions and in compliance with accounting standards. A qualified opinion means that the auditor general found material errors in an entity’s financial statements though the errors were not pervasive meaning the errors were not spread to other components of the financial statements. An adverse opinion indicates that the auditor general found material errors in an entity’s financial statements which were pervasive meaning the errors spread to most if not all components of the financial statements.

There are cases where an entity fails to support the auditor general’s work by either withholding documents or issuing limited information thereby preventing the auditor general from awarding an opinion and this the auditor general issues a disclaimer of opinion. This article focuses on the consequences of a public entity receiving a disclaimer of opinion from the OAG in reference to the Public Finance Management Act 2012 thereby preventing any or further pilferage of public funds. According to the OAG reports several ministries such as the Ministry of Devolution and Planning, various State entities such as the National Youth Service and various donor funded projects have received a disclaimer of opinion. The Public Finance Management Act 2012, Section 94 (1) (d) elaborates that an entity, funded by public funds that has received a disclaimer of opinion is in serious material breach of the act and may trigger Section (97) 1.

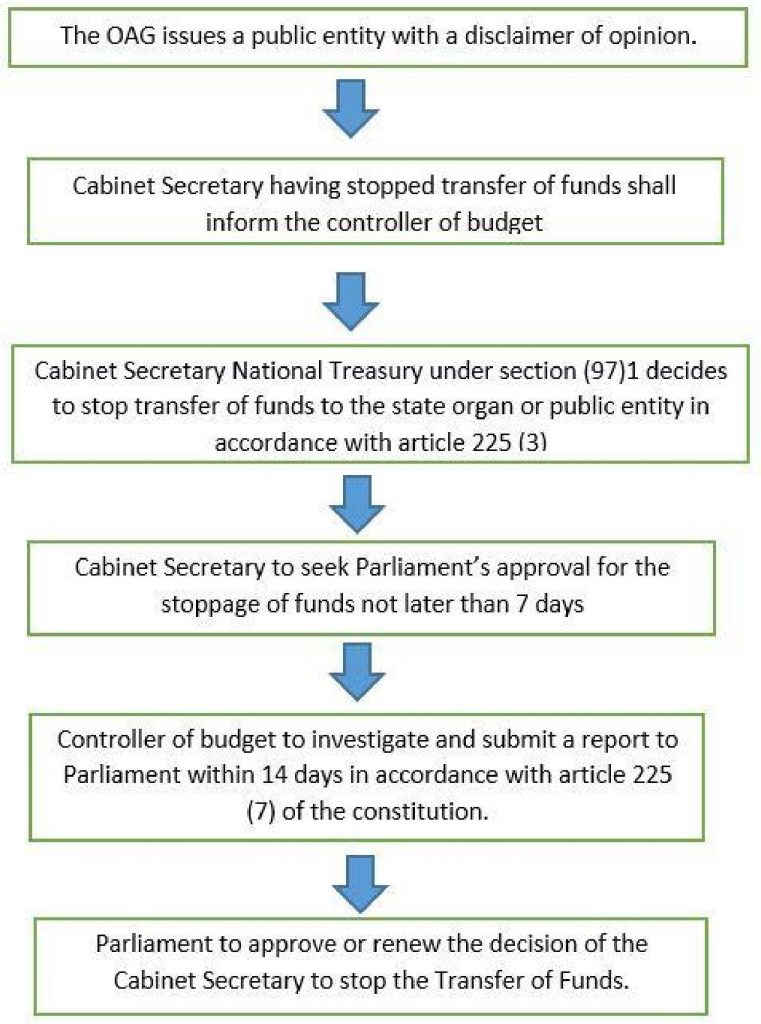

Having considered all relevant information, the Cabinet Secretary National Treasury under section (97) 1 may decide to stop the transfer of funds to a state organ or public entity in accordance with article 225 (3) of the constitution. The Cabinet Secretary shall stop the payment and inform the controller of budget in respect of:

- The date from when the stoppage of transfer of funds takes effect

- The nature of serious material breaches or persistent material breaches committed by the state organ or public entity.

The Cabinet Secretary shall then seek Parliament’s approval for the stoppage of funds to the public entity after which the controller of budget shall investigate and submit a report to parliament within 14 days in accordance with article 225 (7) of the constitution. Parliament shall then approve or renew the decision of the cabinet secretary to stop the transfer of funds and the Cabinet Secretary shall abide by the decision of Parliament. In summary:

The audit reports issued by the OAG provide a good account of how entities funded by public funds utilize the financial resources allocated to them. The audit reports backed by the Public Finance Management Act (2012) can help relevant authorities prevent the misuse of public funds by initiating the process of stopping funds transfer to entities that have been issued a disclaimer of opinion. Let Parliament and other relevant authorities act in the best interest of taxpayers by upholding and implementing the Public Finance Management Act 2012 when confronted by audit reports that indicate public entities issued with disclaimer of opinion